Solaradvice.co.za has a nice interface that can help you estimate cost for a system like that. Generally increasing your mortgage to install solar will give you much lower total cost than going with the rent-to-own options. Off course that makes a lot of sense, since the risk to the bank holding your mortgage is a lot different to the risk of someone installing a solar system in your home. (For one, you could disappear with the equipment, which is a lot harder to do with a house.)

Sure. But this means you are driving the project.

Here they do all the work but I don’t see any promises of your ROI…

There must be a fat deposit that you have to make if they are handling the finances themselves.

Near impossible to give, as it heavily depends on your usage patterns afterward.

Like:

We now have solar power, switch everything on, “the sun pays”.

Or

Now that we have solar power, to get the max ROI, we need to do these lifestyle changes.

Or

Going solar could lead to more insights like having to replace heavy juice appliances …

It is a rabbit hole.

Aaah so similar to what many security companies do (Chub and ADT is fond of that sort of thing). You rent the alarm system. It never becomes yours. I ended up ripping it out and installing a new system at my previous house.

similar in that respect but in this case the “alarm company” is suggesting that you could end up saving money by giving some of your money to them.

If you’re doing it to have backup during load-shedding, and it enables you to be productive during that time, it could be a good idea that will possibly save you money.

Some CCTV/IP camera providers also love this business model.

I presume you do get support…

This would be more viable if the vendor has remote support.

How easy is this with a PV inverter system like this??

Yup. You get support included but you end up paying the actual hardware cost like 2-4 times over the length of the contract.

I had a idea to try this a while ago, but after doing a proper assessment of the idea it didn’t fit into my definition of a passive investment, managing clients, following up on missed payments etc just doesn’t sound like fun, not to mention the risk to capital.

What will you do if go to the site and suddenly you discover your equipment is missing? Sure you can add insurance but this will also increase your cost, or even worse you just bought a couple pallets of panels and a few months later either a technical advancement is made or the rand strengths or both and you can buy the same watts for say 20% less.

I am sure it is a viable business model, just not something I would do ![]()

I am way too lazy, I just want to receive dividends.

Heck I am so lazy I even buy ETF’s who wants to waste time picking shares ![]()

I’m exactly the same. I like a fire-and-forget approach. Log in once a month, buy according to a plan, then come back next month.

In many ways I wish I didn’t bother with property (since 2005) and just stuck everything in ETFs. The amount of trouble involved in long-term renting physical property is just not worth it anymore in my opinion. Everyone is unhappy, especially where you’re buying with a bond in order to let it. The Land Lord barely breaks even by year 12, while the tenant is constantly moaning about the high price of rent and that his kid cannot have a dog because of the postage-stamp-sized backyard.

Speaking of ETFs, quite amazed at how IEMG is bouncing back. With what is going on in East Europe, usually you expect the emerging block to just get punished as a whole. Weirdly, not only is that not happening, the ZAR is appreciating against other currencies (which is not good if you have foreign income, along with rising interest rates AND fuel prices).

I have had a couple of heated / passionate disagreements with friends around the braai about property investments.

Some people just refuse to believe that there are simpler (In my mind better performing too) ways to make money, and if you are buying the property in cash the IRR is even worse.

To quote a line from Steve Eisman: They mistook leverage for genius.

I have only 1 property, I live on it, rent out portions of it to two tenants and that is just about as much as I am willing to deal with property wise, and as my family grows and privacy becomes more of a concern I will eventually drop my tenant count to zero.

IEMG is bouncing back, but it is from a low base. Its still down about 12% over the past year, while VOO is up about 12% over the same timeframe.

IEMG is a very broad index so I can’t speak to its performance, but the rationale behind war being good-ish for SA is well grounded.

Russia and SA collectively produce most of the worlds PGM’s so with sanctions hitting Russia PGM buyers only really have one other large seller to come to: SA ![]()

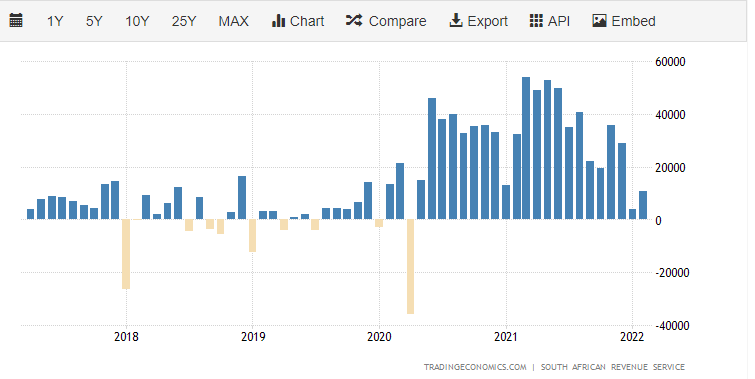

Mining profits since the start of the pandemic have been massive, its lead to SARS collecting more revenue than expected 2 years in row, we have had massive trade surpluses as well the past two years. Just take a look at our balance of trade over the past 5 years and see if you can spot it ![]()

This bonanza in money pouring in has significantly improved SA’s fiscal position, debt-to-gdp is expected to peak lower than expected in the budget speech, and sooner than expected.

Heck, Moodys even upgraded our credit outlook to stable from negative (still junk though)

But considering that our bonds also still provide investors with a real return, and default risk close to zero with current commodity prices I can see why the rand keeps gaining ground.

The only question is… When is the gravy train going to stop?

Commodities are cyclical, so once this turns, we are going to have big trouble.

Yes, VOO is just one of those funds where I always wonder where the catch is, it just never seems to lose momemtum. There was a bit of a hickup as COVID struck, but then it just came right back. India is also doing exceptionally well, while one of the best performers in previous years (Asia sans Japan) is doing rather poorly this year.

I guess the boogeyman in VOO is that its not as diversified as one might believe, you might think I own a piece of 500 companies! What could go wrong?

The problem is that the top 10 holdings represent 27% of the assets.

The craziest stat is that the top holding Apple alone represents 6% of the index…

Same is true of Satrix40. You’re sitting on mostly Naspers if you own that… ![]()

You should go and have a look at the Satrix40 MDD you will be pleasantly surprised to see how the index re balancing has protected you from the slow Naspers price collapse ![]()

Naspers and Prosus combined are only 8% of the index, the top spot now belongs to BHP at 13.7% of the index.

But yes, its a bigger problem than VOO has, the top 3 of the Satrix top 40 represent 39.4% of the index!

Scarier than that is the fact that 2 of those 3 companies are mining companies that are very cyclical.

Like when you try to explain to a homeowner that his house is a liability UNTIL he sells it for a profit.

The trick comes in, that profit … have they tallied up every single cent s[he] has poured into the house from the day it was bought till it was sold?

Probably not.

Nope. But you need somewhere to live, so you tend to ignore that. Not so much with a rental place. There you are painfully aware that you’ve poured a 100k into it (the accumulated difference between the downpayment/taxes/levies and the rent over the first few years of ownership) which you only begin to claw back around year 5 (if you are lucky) or year 12 (if not). As you can see by now… I am not in favour of the buy with a loan and then rent out model. That worked maybe 20 years ago, but it’s over. And if you are someone who’s renting who don’t understand why the market is the way it is… this is why.

Made even worse due to the law if you try to get rid of non-paying tenants. Your ROI goes down the rabbit hole then.

Yes. The infamous PIE law. It was supposed to protect the tenant. All it did was make the rent more expensive. I’ve actually seen insurance products, where a landlord can insure himself against a defaulting tenant and a contested eviction. Do you think for a moment the landlord is paying that out of his own pocket? ![]()

Don’t forget tax though. Some expenses and incomes are deductible, others are not. Rentals can make a lot of sense when you hit the sweet spot between loan interest, rental income & expenses and income tax.

But there’s little point making a couple of percent interest plus income tax on top when you’re paying off a prime-linked loan elsewhere. Or just deferring to a different type of tax later.